The DOWA group has made the strengthening of corporate governance (corporate control) one of its most important management priorities, and the entire group is engaged in developing and operating effective and efficient internal controls based on mission, vision, values and code of conduct of the DOWA group.

In accordance with our Corporate Mission, Vision, Values, and Code of Conduct, the DOWA Group and Group companies have made a collective effort to design and operate effective and efficient internal controls to contribute to society, maximize corporate value, and carry out the responsibilities of management mandated by our shareholders.

We created an internal control system based on the COSO Internal Control Integrated Framework. As a part of this, we are working to promote Enterprise Risk Management (ERM) with reference to COSO and JISQ2001 to prevent any crisis that would have major effects on management and to minimize damages in the event of a crisis. Specifically, we are strengthening and thoroughly promoting a series of risk management processes that includes exposing obvious and potential risks, implementing countermeasures, monitoring, and auditing in all business activities.

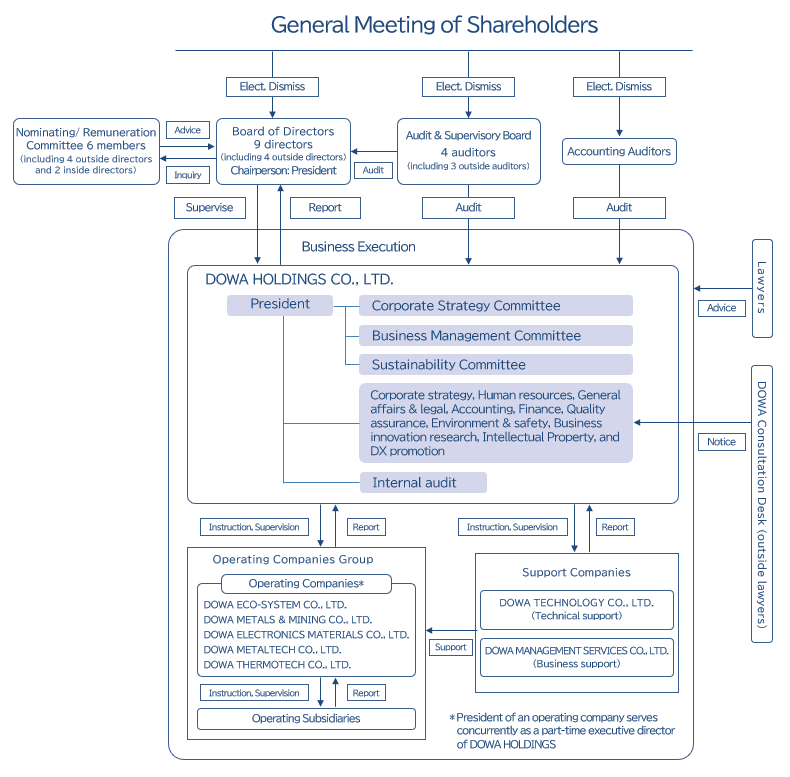

While the holding company system employed by the DOWA Group enables business groups to enhance their expertise and adopt measures more promptly, it also disrupts overall control given increased specialization in certain areas within the control system.

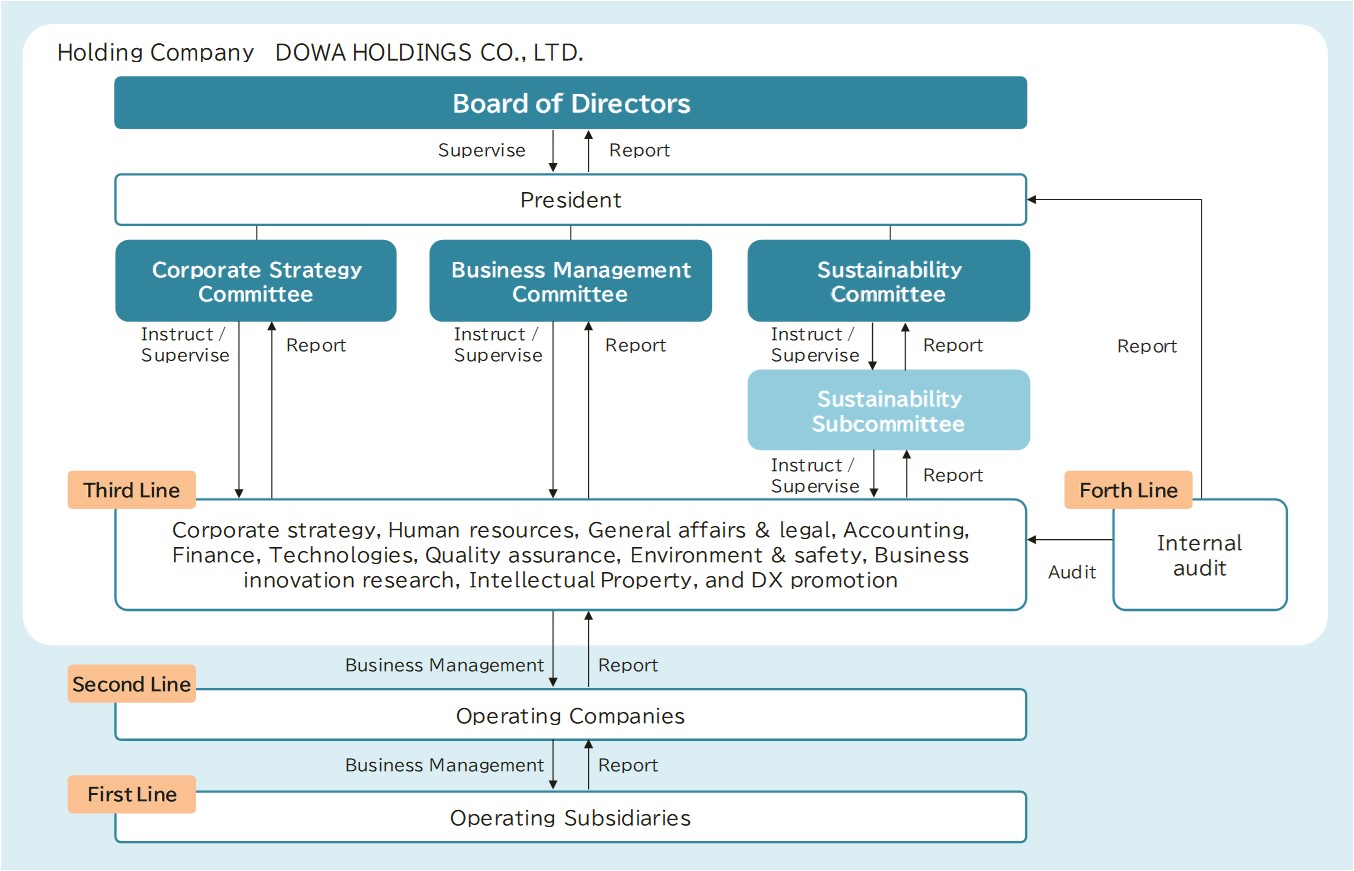

For this reason, all Group companies share the same basic internal control policy, the Rules for internal control system, and we have established the Four Lines Model in accordance with the holding company system, ensuring internal control as a Group. Line I (business execution), Line II (business management), Line III (Group management), and Line IV (Group evaluation) in the Four Lines Model each play a role in internal control. The internal control system must be continuously revised in response to changes in the business and social environment, and we are continuing our efforts to improve and operate this control system.

The DOWA Group engages in risk management to prevent situations that could have a major impact on its business and to prevent or mitigate damage in the unlikely event such a situation comes to pass. Specifically, we will continue efforts to enhance our risk management process, which involves identifying apparent and potential risks at each operating company, implementing countermeasures, monitoring, and conducting audits.

The Group has established a risk management system based on the Four Lines Model for internal control, modeled on three lines of defense. The Operating subsidiaries responsible for production and other operations (first line) and the Operating companies that oversees them (second line) develop a risk management cycle that includes periodic risk assessments. In contrast, each DOWA Holdings division (third line) as the holding company provides necessary instructions, supervision, and support. The Internal Audit Department of DOWA Holdings (fourth line) conducts internal audits to evaluate the effectiveness of these measures. The risk management system is operated by the Sustainability Subcommittee, chaired by the director in charge of corporate planning, which is separated from the Audit & Supervisory Board.

The directors and employees of the Group utilize the DOWA Group Corporate Mission, Vision, Values, and Code of Conduct to guide them in their day-to-day business activities. In addition, our continued efforts to spread awareness of our whistleblower system, combined with the implementation of internal audits, helps with the prevention and early detection of any fraud or misconduct in the Company or at Group companies, and accordingly we take appropriate measures whenever the need should arise.