Pursue quality in circularity

The word "recycling" has been in use for decades in Japan, and the era of pursuing only partial circularity has come to an end.

From now on, it is essential to protect the environment, effectively utilize limited resources, and simultaneously

develop the economy.

This is why DOWA aims for true circularity.

We strive to return as many materials as possible to the cycle from waste and recyclable resources generated worldwide.

For materials that cannot be returned to the cycle, we ensure they are handled properly.

By diversifying product functions and enhancing durability, we aim to extend the use of limited resources.

As the world and Japan now aim to transition to the circular economy,

we will bring together the technologies we have accumulated over 140 years and continue to pursue higher quality in circularity.

DOWA established “Medium-term Plan 2027” covering the three-year period from FY2025 to FY2027 on May 2025.

Circularity has entered an era in which quality matters.

Today, with "recycling" becoming increasingly widespread, we aim to achieve a more integrated, long-term true circularity. By employing new ideas and more advanced technology while coordinating with industry and society as a whole, we pursue the quality in circularity.

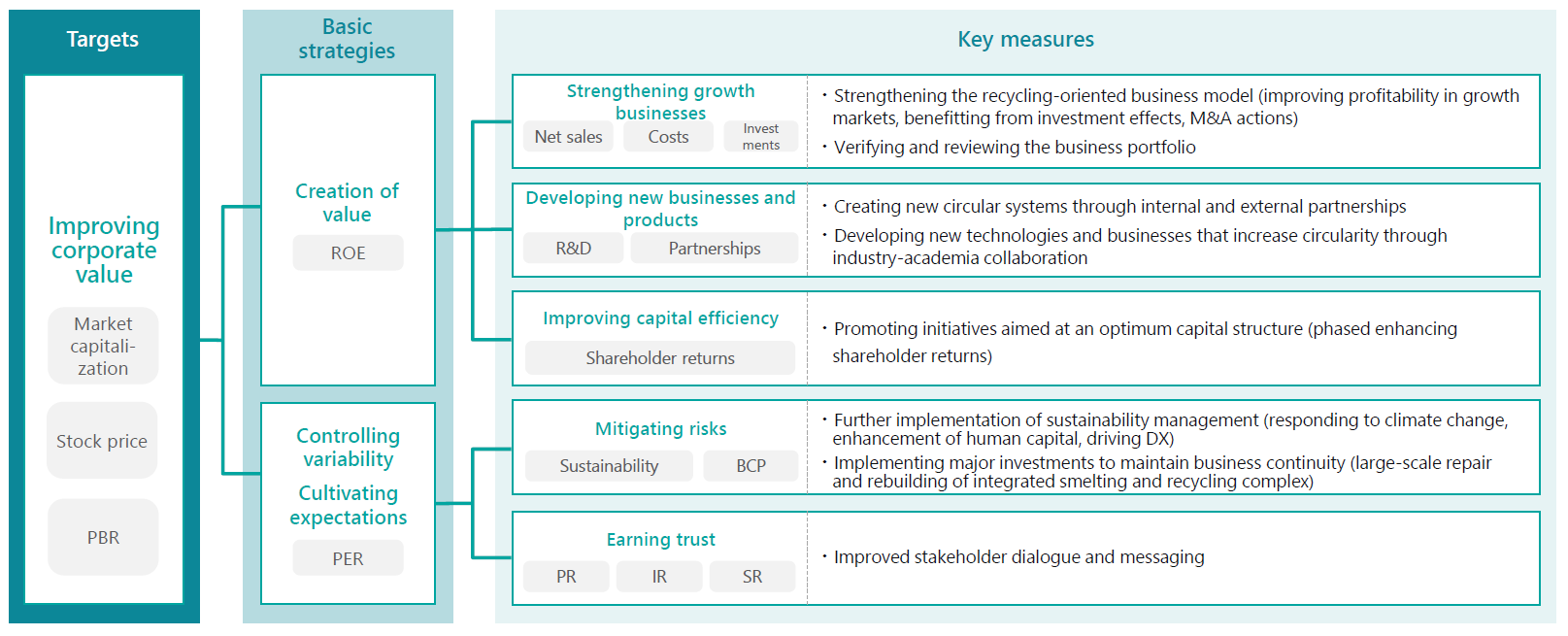

In Medium-term Plan 2027, we aim to improve corporate value through the basic strategies of creation of value, controlling variability and cultivating expectations.

|

Operating Income (billion yen) |

47.0 |

|

Ordinary Income (billion yen) |

60.0 |

|

ROA (%) |

9 or more |

|

ROE (%) |

10 or more |

|

Assumptions |

Medium-term Plan 2027 |

Fluctuation |

Sensitivities (FY2022) |

|

Exchange rate (¥/$) |

142.0 |

±1yen |

490 million yen |

|

Copper ($/ton) |

9,000 |

±100 dollars |

30 million yen |

|

Zinc ($/ton) |

2,600 |

±100 dollars |

530 million yen |

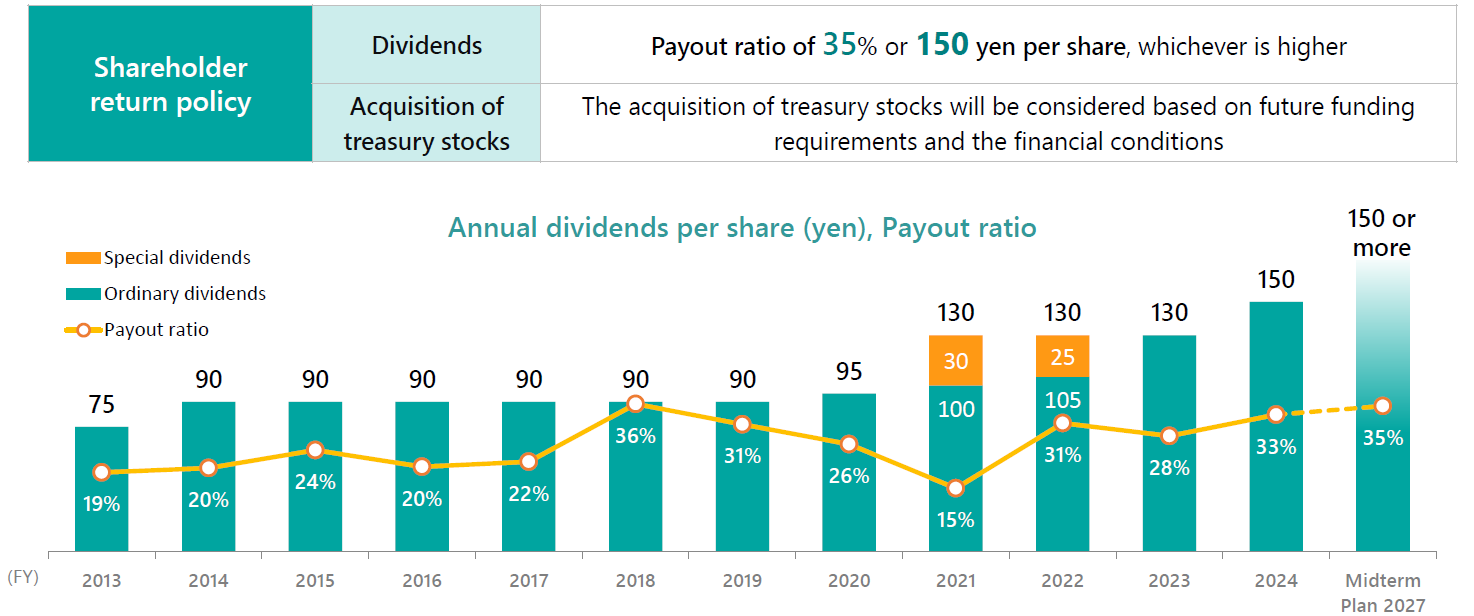

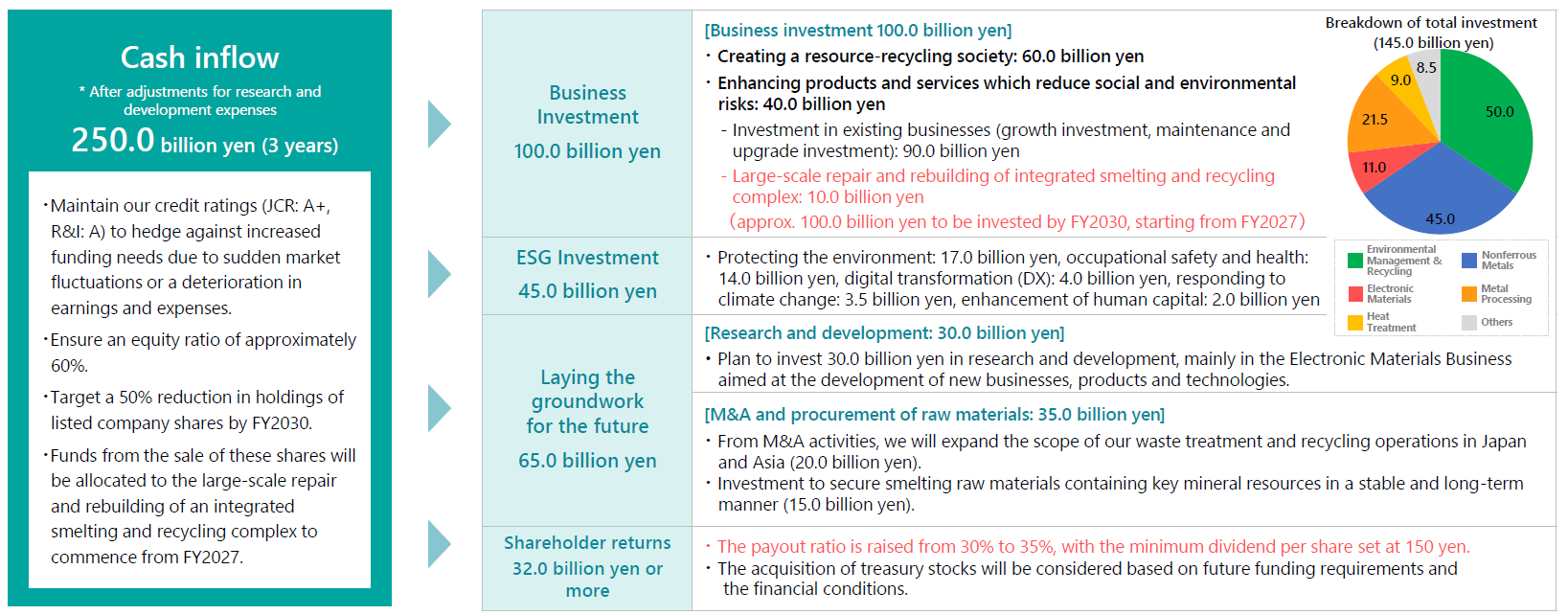

Our capital policy under Medium-term Plan 2027 is premised on maintaining a sound financial base with the basic approach of covering funding needs with the funds generated from business, while improving profit through business investment and enhancing shareholder returns.

DOWA regards the return of profits to shareholders as one of its top management priorities.

Based on this policy, the shareholder return policy for the period of the Medium-term Plan 2027 (FY2025 to FY2027) will be as follows.